EDUCATION, KNOWLEDGE, ENTERTAINMENT YOU CAN PUBLISHED YOUR CREATIONS BY EMAILING at panhwar2005@gmail.com

Saturday, December 20, 2014

Tuesday, December 16, 2014

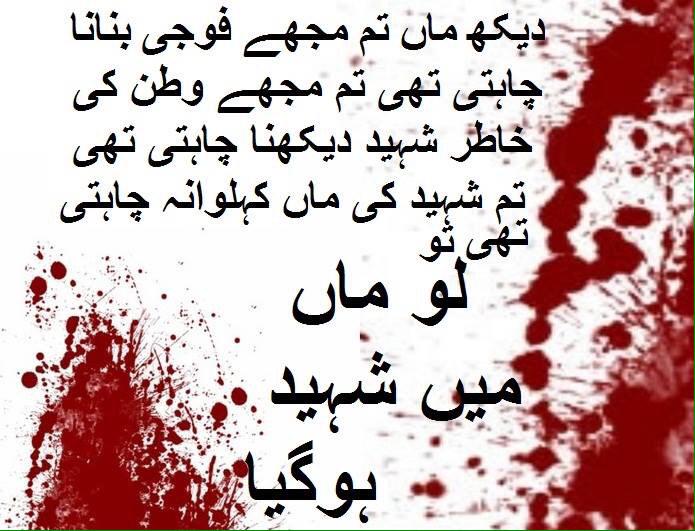

very very sad incident in peshawar. 160 students killed by terrorist.

MOM please rona mat. very very sad incident in peshawar. 160 students killed by terrorist.

mom muje jaldi jana he

mom muje der ho rahi he

mom please jaldi se nashta dedo

mom time pe lene ana muje

mom muje der ho rahi he

mom please jaldi se nashta dedo

mom time pe lene ana muje

mom kiss you mom

mom love you mom

mom, mom, mom, mom and mom bye, bye

mom my lovely mom good byeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee.

very sad

Monday, December 15, 2014

Sunday, December 14, 2014

Saturday, December 13, 2014

Sales Tax Rules 2006 CHAPTER- I REGISTRATION, COMPULSORY REGISTRATION AND DE-REGISTRATION

Sales Tax Rules 2006

CHAPTER- I

REGISTRATION,

COMPULSORY REGISTRATION AND DE-REGISTRATION

3. Application. — The provisions

of this Chapter shall apply to the following persons, namely:--

(a)

a person required to be registered under the Act;

(b)

a person required, under any other Federal law or Provincial law, to be

registered for the purpose of any duty or tax collected or paid as if it were

sales tax under the Act;

(c)

a person who is subject to compulsory registration;

(d)

a person who is already registered and requires a change in the name, address

or other particulars of registration;

(e)

a person who is blacklisted or whose registration is suspended; and

(f)

a person who is required to be de-registered.

4. Requirement

of registration.— The

following persons engaged in making of taxable supplies in Pakistan (including

zero-rated supplies) in the course or furtherance of any taxable activity

carried on by them, if not already registered, are required to be registered in

the manner specified in this Chapter, namely:--

17[(a) a

manufacturer not being a cottage industry;]

(b)

a retailer whose value of supplies, in any period during the last twelve months

exceeds five million rupees;

(c)

an importer;

(d)

a wholesaler (including dealer) and distributor; 18[* * *]

(e)

a person required, under any other Federal law or Provincial law, to be

registered for the purpose of any duty or tax collected or paid as if it were a

levy of sales tax to be collected under the Act 19[; and]

20[(f) a

commercial exporter, who intends to obtain sales tax refund against his

zero-rated supplies.]

17 Clause (a)

Substituted by Notification No. S.R.O. 530(1) /2008 dated 11th June, 2008

w.e.f. 1st July 2008, reported as PTCL 2008 St.1882

18 The words “and”

omitted by Notification No.S.R.O 470(1)/2007 dated 9th June,2007 w.e.f .1st day

of July,2007,reported as PTCL 2007 St.1726.

19 Substituted for

the full stop by Notification No.S.R.O 470(1)/2007 dated 9th June,2007 w.e.f

.1st day of July,2007,reported

as PTCL 2007

st.1726.

20 Clause (f) added

by Notification No. S.R.O 470(1)/2007, dated 9th June, 2007 w.e.f Ist day of

July, 2007 reported as PTCL

2007 st.1726.

Sales Tax Rules 2006

5. Application

for registration.—

(1)

A person required to be registered under the Act shall, before making any

taxable supplies, apply to the CRO, through electronic means as provided by the

Board or otherwise, through owner, member or director, as the case may be. Such

application shall be made in the Form STR-l, as annexed to these rules,

transmitted to the CRO electronically or through registered mail or courier

service. Such application will specify the Collectorate in whose jurisdiction

the registration is sought, as per criteria given below, namely:--

(a)

in case of a corporate person, that is, a listed public limited company or an unlisted

public limited company or a private limited company, the area where the

registered office is located;

(b)

in case of a person not incorporated, the area where the business is actually carried

on; and

(c)

in case of a person not incorporated, having a single manufacturing unit, whose

business premises and manufacturing unit are located in different areas, shall

apply for registration in the Collectorate of the area in whose jurisdiction

his manufacturing unit is located:

Provided

further that a corporate person shall have the option to apply for transfer of

registration to the Collectorate having jurisdiction where the place of

business is located.

(2)

Where an applicant has unsold or un-used stocks of tax-paid Inputs on which he

desires to claim the benefit of section 59 of the Act, he shall declare such

stocks in a statement in the Form set out as STR-4, to be appended with his

application for registration.

21[(2a) CRO may

cause further inquiry from the applicant through LRO or otherwise including issuance

of Objection Slip.]

(3)

On completion of such verification or inquiry, through LRO or otherwise, as the

CRO deems necessary, it may register the applicant and issue a certificate of

registration containing the registration number of the applicant in the Form as

set out in the Form STR-5, or reject the application within fifteen days from

the date complete application is received in the CRO, under intimation to the

applicant, specifying the reasons for such rejection.

22[(4) A person

who has applied for registration as manufacturer shall be registered after LRO has

verified his manufacturing facility

21 Sub _rule (2a)

inserted by Notification No.S.R.O.429(1)/2009,dated 2nd June,2009

22 Sub-rules (4)

&(5)added by Notification No.S.R.O.530(1)2008,dated 11th June,2008, w.e.f.

1st July reported as PTCL 2008 st.1882.

Sales Tax Rules

2006

14

(5)

In no case, a person required to be registered under the Act shall be issued

more than one registration number.] rule

The Sales Tax Act, 1990 for sales tax registration sec.14 & 59

The Sales Tax Act, 1990

3. Scope

of tax.—

(1) Subject to the

provisions of this Act, there shall be charged, levied and paid a tax known as

sales tax at the rate of 1sixteen per cent of the value of--

(a) Taxable supplies made by a

registered person in the course or furtherance of any taxable activity carried

on by him; and

(b) Goods imported into Pakistan.

14.

Registration. –

Under this Act,

registration will be required for such persons and be regulated in such manner

and subject to rules as the Board may, by notification in the official Gazette,

prescribe.

59. Tax paid on stocks acquired before

registration.—

The tax paid on goods purchased by a person

who is subsequently required to be registered under section 14 due to new

liabilities or levies or gets voluntary registration under this Act or the

rules made thereunder, shall be treated as input tax, provided that such goods

were purchased by him from a registered person against an invoice issued under

section 23 during a period of thirty days before making an application for

registration and constitute his verifiable unsold stock on the date of

compulsory registration or on the date of application for registration or for

voluntary registration:

Provided

that where a person imports goods, the tax paid by him thereon during a period

of ninety days before making an application for registration shall be treated

as an input tax subject to the condition that he holds the bill of entry

relating to such goods and also that these are verifiable unsold or un-consumed

stocks on the date of compulsory registration or on the date of application for

registration or for voluntary registration.

http://www.spsc.gov.pk/advertisement-05_2014.html last date is 18-12-2014

http://www.spsc.gov.pk/advertisement-

05_2014.html

last date is 18-12-2014

Friday, December 12, 2014

researchers say that men can not do two things at once and mans best friend

researchers say that men can not do two things at once

THE SALES TAX RULES 2006

THE

SALES TAX

RULES 2006

Updated By

Mr. Hamid Hussain

Joint Director

Sales Tax & Federal Excise Wing

Federal Board of Revenue

Islamabad.

Phone No. 051-9205360

May not be use as a reference in courts

Sales Tax Rules 2006

1

THE SALES TAX RULES, 2006................................................................................................................6

1. Short title, application and commencement. .............................................................................6

2. Definitions.....................................................................................................................................6

CHAPTER- I ..............................................................................................................................................12

REGISTRATION, COMPULSORY REGISTRATION AND DE-REGISTRATION.......................12

3. Application..................................................................................................................................12

4. Requirement of registration......................................................................................................12

SALES TAX

RULES 2006

Updated By

Mr. Hamid Hussain

Joint Director

Sales Tax & Federal Excise Wing

Federal Board of Revenue

Islamabad.

Phone No. 051-9205360

May not be use as a reference in courts

Sales Tax Rules 2006

1

THE SALES TAX RULES, 2006................................................................................................................6

1. Short title, application and commencement. .............................................................................6

2. Definitions.....................................................................................................................................6

CHAPTER- I ..............................................................................................................................................12

REGISTRATION, COMPULSORY REGISTRATION AND DE-REGISTRATION.......................12

3. Application..................................................................................................................................12

4. Requirement of registration......................................................................................................12

The Sales Tax Act, 1990 (Act No. III of 1951 as Amended by Act VII of 1990)

The Sales Tax Act, 1990

(Act No. III of 1951 as Amended by Act VII of 1990)

The Sales Tax Act, 1990

1

INDEX

Chapter I ................................................................................................................. 8

PRELIMINARY ............................................................................................... 8

1. Short title, extent and commencement.- .................................................... 8

2. Definitions.― ................................................................................................. 8

Chapter-II ............................................................................................................. 22

SCOPE AND PAYMENT OF TAX .................................................... 22

3. Scope of tax.— ............................................................................................ 22

4. Zero rating.— .............................................................................................. 26

5. Change in the rate of tax.— ...................................................................... 27

6. Time and manner of payment.― ............................................................... 27

7. Determination of tax liability.― ................................................................ 28

[7A. Levy and collection of tax on specified goods on value addition.—

29

[8. Tax credit not allowed.— .......................................................................... 30

[8A. Joint and several liability of registered persons in supply chain where

tax unpaid.– .......................................................................................................... 32

[8B. Adjustable input tax.– ........................................................................... 32

9. Debit and credit note.— ............................................................................ 33

[10. Refund of input tax.— ............................................................................. 33

[11. Assessment of tax and recovery of tax not levied or short-levied or

erroneously refunded.― ...................................................................................... 35

[11A. Short paid amounts recoverable without notice.– ............................. 36

[13. Exemption.― ............................................................................................. 37

The Sales Tax Act, 1990

2

Chapter-III ............................................................................................................ 38

(Act No. III of 1951 as Amended by Act VII of 1990)

The Sales Tax Act, 1990

1

INDEX

Chapter I ................................................................................................................. 8

PRELIMINARY ............................................................................................... 8

1. Short title, extent and commencement.- .................................................... 8

2. Definitions.― ................................................................................................. 8

Chapter-II ............................................................................................................. 22

SCOPE AND PAYMENT OF TAX .................................................... 22

3. Scope of tax.— ............................................................................................ 22

4. Zero rating.— .............................................................................................. 26

5. Change in the rate of tax.— ...................................................................... 27

6. Time and manner of payment.― ............................................................... 27

7. Determination of tax liability.― ................................................................ 28

[7A. Levy and collection of tax on specified goods on value addition.—

29

[8. Tax credit not allowed.— .......................................................................... 30

[8A. Joint and several liability of registered persons in supply chain where

tax unpaid.– .......................................................................................................... 32

[8B. Adjustable input tax.– ........................................................................... 32

9. Debit and credit note.— ............................................................................ 33

[10. Refund of input tax.— ............................................................................. 33

[11. Assessment of tax and recovery of tax not levied or short-levied or

erroneously refunded.― ...................................................................................... 35

[11A. Short paid amounts recoverable without notice.– ............................. 36

[13. Exemption.― ............................................................................................. 37

The Sales Tax Act, 1990

2

Chapter-III ............................................................................................................ 38

Wednesday, December 10, 2014

Tuesday, December 9, 2014

Saturday, December 6, 2014

Thursday, December 4, 2014

http://www.arydigital.tv/videos/category/jeeto-pakistan/

http://www.arydigital.tv/videos/category/jeeto-pakistan/

http://www.arydigital.tv/videos/jeeto-pakistan-5th-september-2014-2/

Additional Sesions judges job advertisement , HIGH COURT OF SINDH, KARACH 25th November, 2014 I

HIGH COURT OF SINDH, KARACHI

No. GAZ/VI.A.8(V)/I Karachi, dated the 25th November, 2014

ADVERTISEMENT

Applications are invited on “Prescribed Form” from Citizens of Pakistan having

Domicile and Permanent Residence of Province of Sindh for appointment on regular basis

against some vacant posts of “Additional District & Sessions Judge (B-20)” with

approximate salary of Rs.187,467/= (Rupees One Lac Eighty Seven Thousand Four

Hundred Sixty Seven only) and privileges including full medical cover for self and family,

official car with fuel and accommodation where available.

ELIGIBILITY:s

i) He/She shall have a Degree in Law from a recognized University or a Barrister

of Law from England or Ireland or is a Member of the Faculty of Advocates of

Scotland.

ii) Six (6) years’ experience as practicing Advocate of High Court and the Courts

Sub-ordinate thereto OR has for a period of not less than six years held a

Judicial Office with clean record of service.

iii) He is otherwise also qualified in accordance with the law.

Application Form should reach the undersigned not later than 31.12.2014

ENCLOSURES:

The applications shall be accompanied by attested copies of

certificates/testimonials evidencing; (a) Date of Birth (b) Qualification (c) Date of

Enrolment as Advocate / Pleader (renewed up to date), (d) Domicile (e)

Permanent Residence (f) C.N.I.C. (g) Certificate of Character from the Principal

Academic Officer of the academic institution last attended, (h) Certificates of

Character from two respectable persons not being his relatives (i) four latest

photographs (j) Pay Order / Demand Draft of Rs. 1500/= (non-refundable) in

favour of the Registrar, High Court of Sindh, Karachi.

NOTE:

i) The candidates, who have already applied for the said posts in response to

the Advertisement dated 15.7.2013, need not apply afresh as their

applications are already under consideration.

ii) The Application Forms are available at High Court of Sindh, Karachi, all

District Courts in Sindh and Website: www.sindhhighcourt.gov.pk

a. Original documents shall have to be produced at the time of interview.

b. Ineligible candidates and those not fulfilling the conditions or submitting

incomplete applications will not be considered.

c. Applications received after last date shall be rejected.

d. The candidates are required to furnish their email address, which is Mandatory.

e. The applicants holding Judicial Office and office of DA, DDA, DPP, & DDPP shall

apply through proper channel with copy of Appointment Notification/Order.

f. No T.A/D.A. will be admissible.

( MUHAMMAD ASHRAF )

Additional M.I.T-I

No. GAZ/VI.A.8(V)/I Karachi, dated the 25th November, 2014

ADVERTISEMENT

Applications are invited on “Prescribed Form” from Citizens of Pakistan having

Domicile and Permanent Residence of Province of Sindh for appointment on regular basis

against some vacant posts of “Additional District & Sessions Judge (B-20)” with

approximate salary of Rs.187,467/= (Rupees One Lac Eighty Seven Thousand Four

Hundred Sixty Seven only) and privileges including full medical cover for self and family,

official car with fuel and accommodation where available.

ELIGIBILITY:s

i) He/She shall have a Degree in Law from a recognized University or a Barrister

of Law from England or Ireland or is a Member of the Faculty of Advocates of

Scotland.

ii) Six (6) years’ experience as practicing Advocate of High Court and the Courts

Sub-ordinate thereto OR has for a period of not less than six years held a

Judicial Office with clean record of service.

iii) He is otherwise also qualified in accordance with the law.

Application Form should reach the undersigned not later than 31.12.2014

ENCLOSURES:

The applications shall be accompanied by attested copies of

certificates/testimonials evidencing; (a) Date of Birth (b) Qualification (c) Date of

Enrolment as Advocate / Pleader (renewed up to date), (d) Domicile (e)

Permanent Residence (f) C.N.I.C. (g) Certificate of Character from the Principal

Academic Officer of the academic institution last attended, (h) Certificates of

Character from two respectable persons not being his relatives (i) four latest

photographs (j) Pay Order / Demand Draft of Rs. 1500/= (non-refundable) in

favour of the Registrar, High Court of Sindh, Karachi.

NOTE:

i) The candidates, who have already applied for the said posts in response to

the Advertisement dated 15.7.2013, need not apply afresh as their

applications are already under consideration.

ii) The Application Forms are available at High Court of Sindh, Karachi, all

District Courts in Sindh and Website: www.sindhhighcourt.gov.pk

a. Original documents shall have to be produced at the time of interview.

b. Ineligible candidates and those not fulfilling the conditions or submitting

incomplete applications will not be considered.

c. Applications received after last date shall be rejected.

d. The candidates are required to furnish their email address, which is Mandatory.

e. The applicants holding Judicial Office and office of DA, DDA, DPP, & DDPP shall

apply through proper channel with copy of Appointment Notification/Order.

f. No T.A/D.A. will be admissible.

( MUHAMMAD ASHRAF )

Additional M.I.T-I

Subscribe to:

Comments (Atom)

-

Class Five - 5 Sindhi all lessons solved Exercises along with Question and Answers according to STB syllabus

-

MCQs PAKISTAN PENAL CODE 1860 1. Pakistan Penal Code, 1860 was enacted on ________ A. ...

-

Code Of Criminal Procedure 1898 PAKISTAN 1. The Code of Criminal Procedure, 1898 was passed or enacted on ...

-

Class Four - 4 Sindhi all lessons solved Exercises along with Question and Answers according to STB syllabus

-

MCQs Code of Civil Procedure 1908 Pakistan Part-I 1. The Code of law which deals with Courts of Civil Judicature i...

-

MCQs Constitution of Pakistan 1973 enforced on 14 August 1973 as said as By-Cameral law in Pakistan 1. Constitution of 197...

-

Qanun-e-Shahadat, 1984 PAKISTAN 1. Qanun-e-Shahadat, 1984 was made by the President on _______ A....

-

Reading Comprehension Passages with Q&A Passage Philosophy of Education is a label applied to the study of the purpose, process, natu...

-

US-AID announced 13000 vacant posts of HST, JST, PST, SLT, ALT & non teaching staff for new project named US-AID-SINDH TEACHING PROGRA...

.jpg)